Run the Numbers

You want to create personal wealth, right? If we make a good income each year and spend it all, we’re not getting wealthier, we’re just living high. So, first things first. Let’s get a handle on income and expenses and get out of debt so our personal math works for us, not against us. Bottom line, if we’re paying more interest than we’re earning, we’re losing money. Plus, the interest we’re paying is money that cannot be saved or invested — it’s just gone!

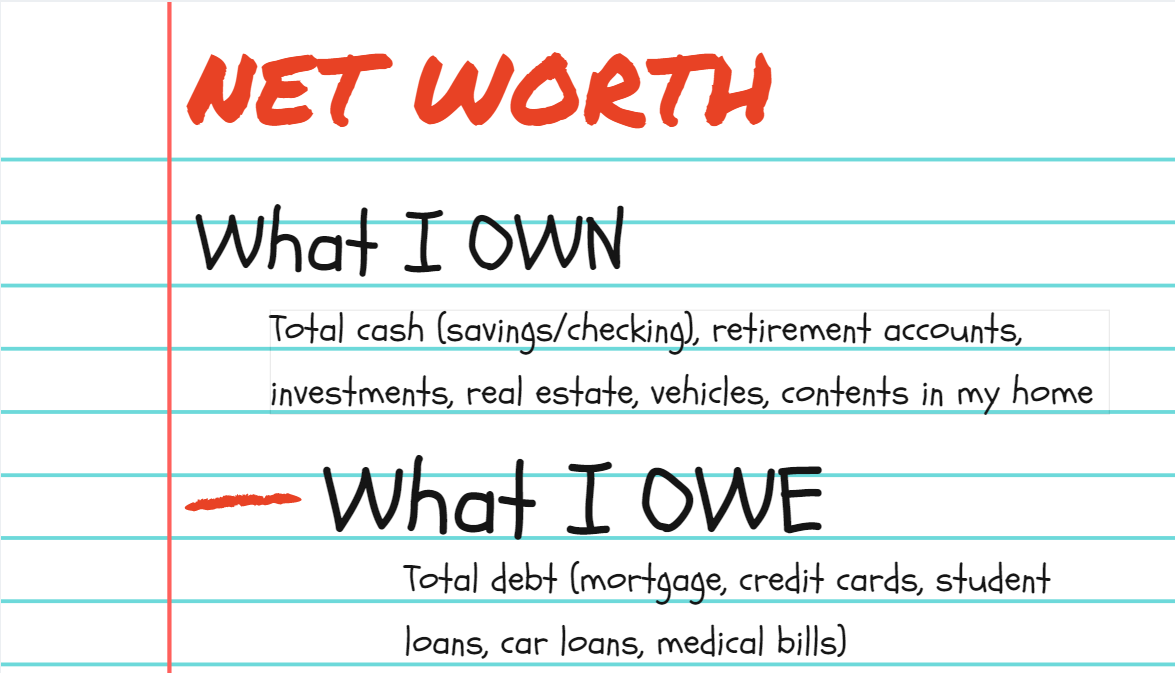

What are you worth? Net worth is our wealth – the greater our assets, the greater our wealth. Our net worth is simply a number that reflects our financial choices – nearly every financial decision we make will move our net worth number forward or backward. If we’re behind our goal, it might be a sign that our relationship with money is broken.

Calculating our net worth is pretty straight forward…

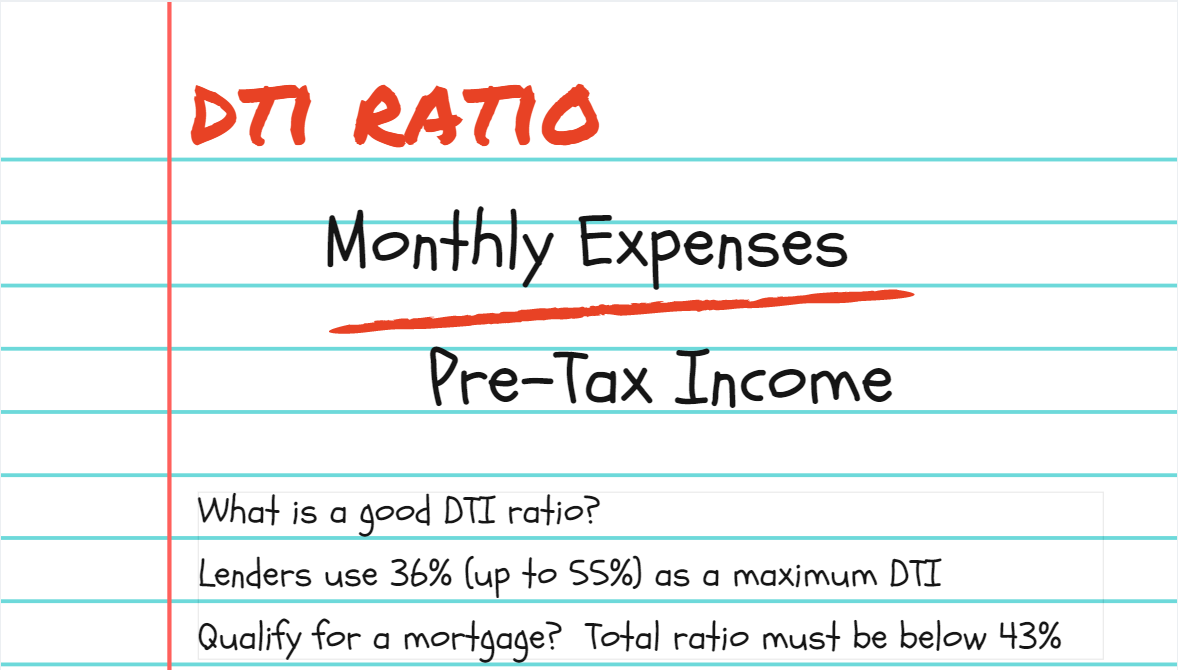

Debt-to-income ratio (DTI) ratio: Another very important number to keep our eyes on. Our DTI ratio shows how our debt stacks up each month compared to our income. It helps us determine how we should handle our debt and whether we have too much debt.

Are there months when you feel like all your money goes to making payments on your debt? You may have a high DTI on your hands. A higher DTI ratio (50% or higher) means we have limited money to save or spend. To get your debt-to-income ratio under better control, focus on paying down debt.

Have Too Much Debt?

It’s safe to assume that most of us carry some kind of debt. And, debt can hurt … I mean, REALLY hurt! It’s impossible to build any real wealth with a mountain of debt hanging over our heads. Our paycheck is our most powerful wealth building tool, and debt is sucking away our income – one dollar at a time!

Hate budgeting? “Make a budget” is one of the most overplayed pieces of financial advice. Budgeting is a great tactic for people who stick with it but, the reality is, most of us won’t stick with it. Good news! We don’t need to with a technique called the “anti-budget,” and it’s simple. Decide how much you want to save and pull this off the top. Set this money aside in an account that allows you to save and invest in a tax-advantaged way! Now, relax about the rest. The purpose of this “budget” is to make sure you’re saving enough. Whatever is left over, you can spend it. It’s that simple!

“Saving” is shorthand for boosting your net worth. When saving, think any activity that improves your financial health like aggressively wiping out your credit card debt, investing or literally savings cash with compounding interest.

How much should I save? We believe everyone should save at least 15% of their income. Is financial independence your goal? Aim for 20% and greater.

How should I save? Here’s a step-by-step plan. (1) Have a 401(k)? Get your employer match! (2) Build an emergency fund. (3) Wipe out debt with an interest rate greater than 4%. And, pay off high-interest credit card debt first. It’s a “no-brainer” … many credit cards charge rates as high as 29.9%, and paying interest on top of interest is a BAD deal!

Need a blueprint? The first step to getting out of debt is to set up a debt payment plan. A good debt payment plan will help you to concentrate on the extra money that you are paying on debt and really speed up the time that it takes you to pay off all your debts. It should tell you the order that you should pay off your debts.

Our Weekend Challenge: Get Out of Debt

What could you do if you didn’t have a single debt payment in the world? That’s right! NO mortgage payment! NO student loan payment! NO car payment! NO credit card bills!

I challenge you to NOW step up and own your debt. You can do the hard work now, or the impossible work later. This weekend challenge is to set your debt elimination plan into place. It’s time to develop a plan!