The Impact of Taxes

Ever think about all the taxes we pay? Over the course of our lifetime, we pay nearly half of our income to a variety of taxes like these: income tax (federal, state, local), sales tax, payroll tax (Social Security 6.25%, Medicare 1.45%), excise tax (gasoline, cigarettes, cell phone, hotels), property tax, estate tax and gift tax. We pay, on average, 30% or more of our income to taxes. The sad truth? Approximately 1/3 of the income we have left after taxes will be spent paying down interest. No one wants to watch their retirement assets go into Uncle Sam’s pocket. Let’s become more efficient with our taxes! It’s one way to get back some of the 54% to 64% we’ve given away in taxes and interest.

Capital Gains Tax

When it comes to our investments, there are 3 critical taxes:

Ordinary income tax. Are you a high income earner? Your combined federal and state income taxes are nearing (or exceeding) 50%.

Long-term capital gains. Are you holding investments longer than one year before you sell them? You will pay a long-term capital gains tax, currently 20%.

Short-term capital gains. Do you sell your investments in the first year? You are subject to short-term capital gains tax … it’s the same as your ordinary income tax.

Taxes have the potential for taking the biggest bite out of our total returns. It pays to be sensitive to taxes as we’re creating wealth.

Not All Money is Taxed the Same!

There are 2 ways on our money is taxed – immediately (when we earn it) and deferred (when we take it out of our retirement accounts). Let’s talk about 3 ways how money set aside for our future is taxed.

Taxable: With a taxable account (checking, savings, money markets, securities), we put in dollars that have already been taxed. The growth is taxable each year (note, securities held do not create a taxable event until sold). As these accounts grow, so does our tax bill.

Tax Deferred: The dollars we “defer” to these plans are deposited pre-tax and grow tax deferred until we withdraw them from the plan. Here’s what we forget: we have to pay Uncle Sam. The income we withdraw from these accounts is taxed at whatever the future rate will be at that time. The question becomes: Is deferring taxes better than paying taxes now?

Tax Free: We can avoid a big tax surprise! In these accounts, we set aside pre-taxed dollars that will grow and be used tax free in the future, minimizing our future tax burden.

When we evaluate where we’re putting our savings (especially baby boomers), we find people are retiring with almost all their assets in tax-deferred accounts. And, it’s becoming problematic. Too many savers are finding out in retirement that they have been misinformed.

We’ve been taught to put our money into 401(k)s and IRAs. We’re told to grow our nest eggs here because, when we retire and have to pay income taxes on these funds – and, we will have to pay taxes on every dollar we withdraw – we should be in a lower tax bracket. But, this just isn’t so in so many cases. The reality is, deferring taxes is a roll of the dice. Deferring is just postponing.

So, the next big question is: Do you think taxes will be higher in the future?

4 Tax Mistakes That Can Ruin Your Retirement

Sadly, taxes don’t end when we retire. The IRS still wants its share of our retirement earnings. But, we could pay more taxes if we ignore these four retirement tax mistakes.

(1) We assume we will pay less taxes in retirement. We know that the national debt is skyrocketing out of control. If tax rates increase (and, we believe that it will) we will have a higher tax bill in retirement.

(2) We forget to plan for Social Security taxes. Ever heard of a thing called provisional income? Provisional income is what the IRS uses to determine whether or not our social security benefits will be taxed. Yes, Social Security benefits can be taxable!

(3) Roth IRAs have limitations. Distributions that include earnings are free of tax as long as the account is at least 5 years old. If we withdraw earnings before age 59½, we may have to pay both income tax and a 10% penalty. And, the maximum annual contribution is $6,000 under age 50. Contributing this amount each year into a Roth IRA is not likely to grow enough to help us achieve financial independence.

(4) When we withdraw from our retirement accounts, there is a “right order.” It’s important to consider the best way to time withdrawals from our resources. You might discover that your 401(k) needs to continue to have exposure to longer-term growth due to market downturn.

It’s Not What You Make, But What You Keep

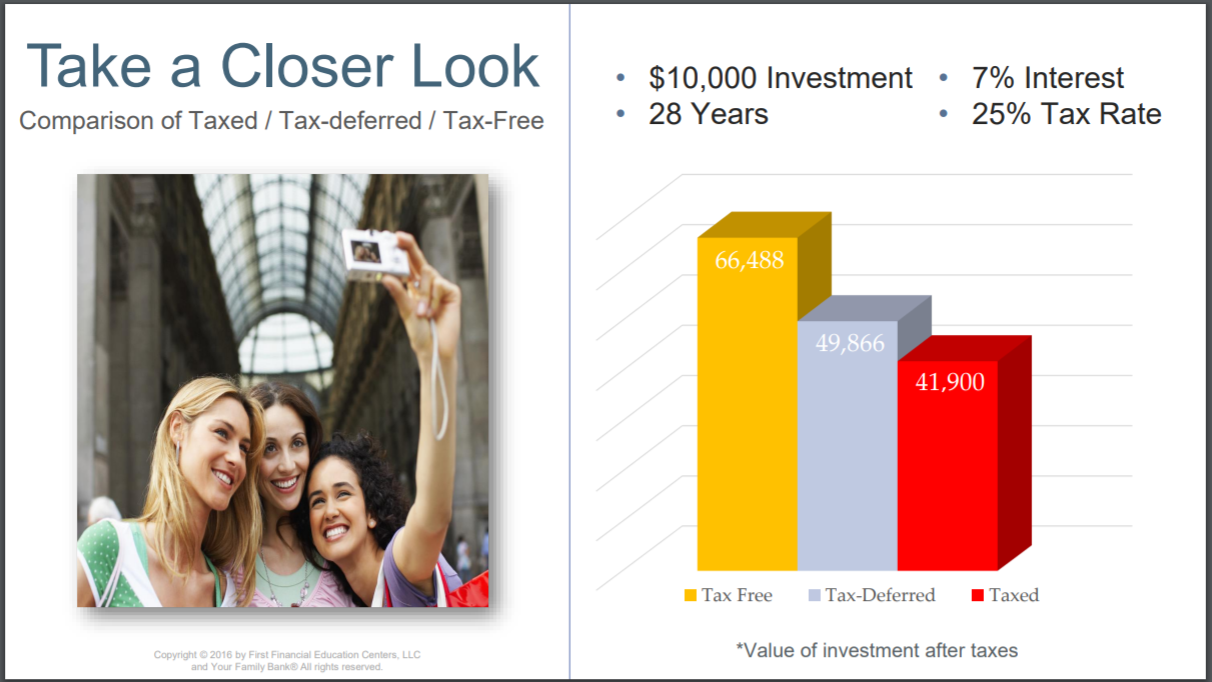

We love to get big tax refunds – it’s like found money, right? No! The reality is, if you get a big tax refund, you’ve just given the government an interest-free loan! Saving in a tax-free account today means a lower tax bill when we retire. Let’s compare a fully taxable investment to two tax-advantaged situations. In one situation, the investment account is not taxed until the money is withdrawn. In the second scenario, the money is an investment that is not subject to federal or state tax.