Pay Extra Toward Mortgage Principal? Not So Fast!

Congratulations, you recently bought a new home and your mortgage company just sent you a payment statement which included this teaser: “You can save a lot of money by paying extra each month.” Before you jump on that, consider this.

Unlike most loans, mortgage interest is calculated differently. During the early years of a home loan, the majority of your monthly payment is interest. It is only after making payments for many years that you start paying more principal than interest.

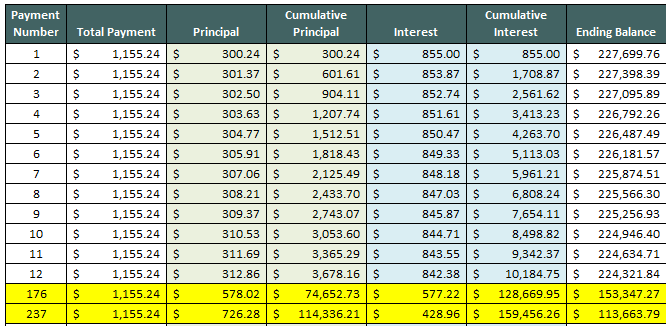

You can see how this works in the below amortization schedule. The first monthly mortgage payment consists of $300.24 in principal and $855.00 in interest. In short, the first payment on a mortgage is “mostly interest” … in fact, interest accounts for nearly 74% of the first payment. In the second month, the payment is still $1,115.24 but the composition of payment changes slightly. The principal portion increases to $301.37 while the interest portion drops to $853.87.

Why is this? The first month’s principal payment of $300.24 lowered the outstanding balance from $227,669.76 to $227,398.39. Therefore, the interest due in the second month decreased and the principal increased. The payment amount stays constant.

This trend continues over time. i.e., the principal portion of the monthly mortgage payment increases while the interest portion decreases. This is the “front-loading” argument you hear about, how interest makes up the lion’s share of early payments.

But, in month 176 (14.7 years into the mortgage), the principal portion of the mortgage payment ($578.02) finally surpasses the interest portion ($577.22). The outstanding balance is still a hefty $153,347.27, or 67.3% of the original balance.

It’s not until month 237 (nearly 20 years into the loan) that the outstanding balance ($113,663.79) falls to less than half of the original loan amount.

In reality, most homeowners don’t hold their mortgage for the full term (average is 5-7 years). They never get to the point where the principal actually surpasses the interest.

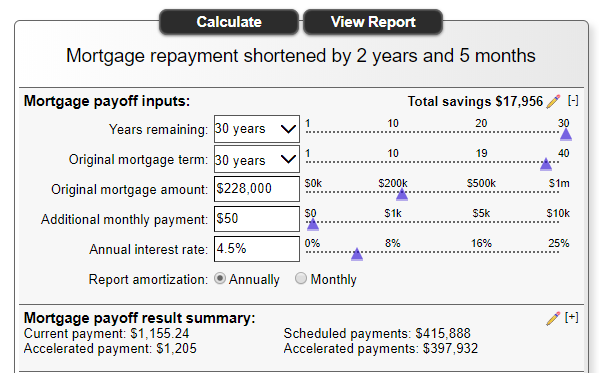

Let’s assume you do hold your mortgage for the full term, and you pay extra each month to help you save money on interest and pay off your loan faster. You decide to increase your monthly payment by $50. Assuming all monies are applied toward principal, total savings will be $17,956 and your mortgage repayment has been shortened by 2 years, 5 months.

Instead, let’s say that you decide to invest this $50 each month. You decide that, every month, you will deposit $50 in a safe money account earning 4.5% interest compounded annually. As you can see, your investment will outperform the interest cost of your mortgage over the long term — in 30 years you will have an account balance of $36,604.24.

Wealth is Created By Investing, Not By Paying Down Debt

The power of compound interest shows how you can really put your money to work and watch it grow. Compound interest is the marvelous force behind many of the world’s great fortunes. The real magic of compounding reveals itself over long periods of time. Even modest returns can generate weal wealth given enough time and dedication. Since words cannot adequately describe the magical nature of compound interest, we have a visual here.