Reaching Financial Freedom

Will you be ready to retire when the time comes? Personally, I don’t care much about the idea of retirement – I believe in finding meaningful work that you’re excited about! Why stop doing something you look forward to every day? I do, however, believe in financial freedom – the point when we no longer have to bring in an active income to maintain our lifestyle.

Want a glimpse of what’s possible? We offer a new tool that will either inspire you or surprise you, depending on your perspective and situation. It’s called My Freedom Date and it allows you to find the point in which you can become debt free (even if you retire later or not).

The idea behind My Freedom Date is that, once you manage to pay off all your debts, including your mortgage, you will then be able to start investing the total of your freed-up debt payments, plus any additional funds you were applying to your debt repayment plan. This is where you turn the tables on the lenders who have been getting rich off your interest payments and exciting things start to happen for you!

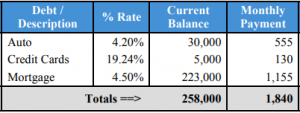

So, will you be ready to retire when the time comes – or at least achieve financial freedom? To obtain your Freedom Date, you will first need to calculate your estimated total debt payments including current balance, total minimum monthly payments and average interest rate. This is a preliminary analysis and, naturally, everyone’s needs are unique. Use the below form to input your own variables and see what you come up with.

One Final Word. Earning and keeping your trust is at the core of our business. We will never ask for your account numbers, social security number or any other personal/financial identifiable information. Keeping client information secure, and using it only as our clients would want us to, are matters of principle for all of us.

Please be generic when providing information. For us, it’s all about the numbers!