Fees Matter in Your 401(k)

Today, we’re taught to keep our wealth in two places – our homes and our 401(k).

Let’s talk about your 401(k). They say you have to spend money to make money, right? But the money we pay to invest has a big effect on what we have left in our own pocket! Most of us don’t feel qualified to make decisions about our investments, so we put our retirement savings in a 401(k) and hope for the best. Chances are high that you’re heavily invested in mutual funds. Do you know how much you’re being charged? All investments have costs even if you don’t realize you’re paying it … after all, it costs money to run a mutual fund. Mutual fund investments are on autopilot and we can easily forget just how much they are costing us.

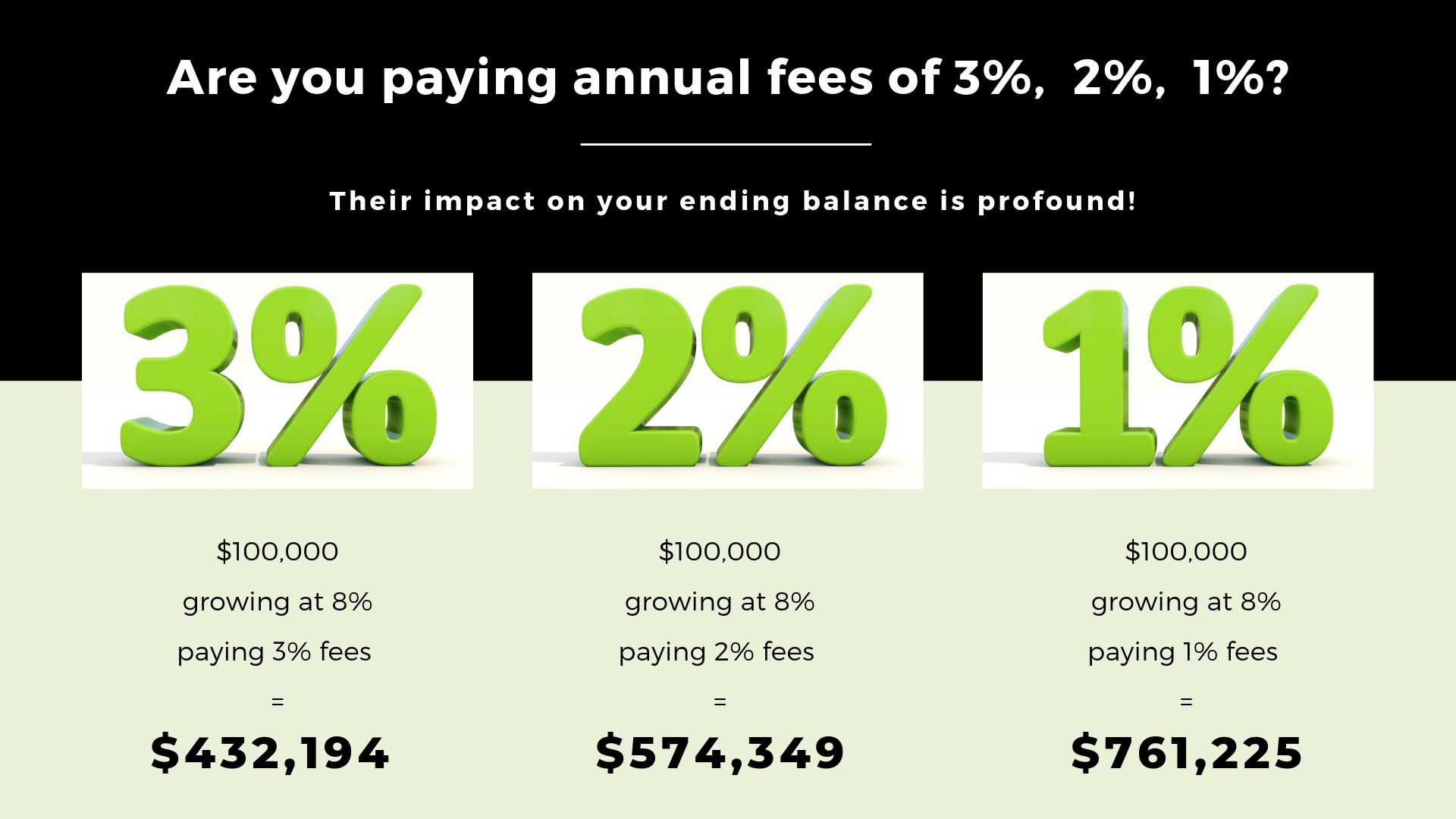

Imagine you invest $100,000 and the account earns 6% every year for 25 years. Without costs or fees, you’d end up with about $430,000 at the end of 25 years. On the other hand, if you paid 2% each year in costs, after 25 years you’d only have about $260,000. That’s right! The 2% you paid every year would wipe out almost 40% of your account value. A 2% fee doesn’t sound so small anymore, does it? To make matters worse, studies show that the high fees charged by mutual funds almost never lead to increased performance.

Hidden fees on mutual funds average an astronomical 3.17%.

As you figure out where and how to invest, it’s easy to overlook one thing – investment and brokerage fees. That’s a problem! Fees can eat into your investment returns. It’s important that you know what you’re paying.

Even a small brokerage fee will add up over time. A few investment fees together can significantly reduce your return. If you’re account is up 6% for the year but you pay 1.5% in fees and expenses, you’re return is only 4.5%. Over time, that difference really adds up! Consider what happens when the market drops 20%. Yes, you will still pay fees.