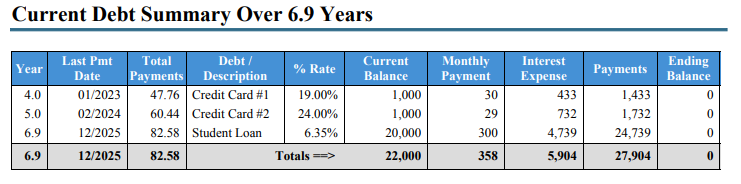

Your minimum monthly payment is $358. If you’re able to budget $400 for debt repayment, you would send the extra $42 to Credit Card #1, your smallest debt.

Repeat this process every month until Credit Card #1 is paid off. When that happens, move all your extra dollars towards paying off Credit Card #2, the next smallest debt. Note, this includes $72 ($30 monthly payment plus $42 extra payment) previously allocated to the minimum payment on Credit Card #1.

In short, you’ll pay your debts from the smallest to the largest, gaining momentum as each balance is paid off. When you retire one debt, you move on to the next, paying off each debt more rapidly as you have more dollars available to put to the next debt.

Snowball vs. Avalanche: Which is Best for You? Mathematically speaking, a debt avalanche is more likely to pay off debt in a shorter time and save you the most money on interest. This payoff method targets debts with the highest interest rate first. When developing a plan, we may take both methods into consideration. If you need short-term victories to inspire you, you’re a debt snowball candidate. If you tend to be analytical and patient, a debt avalanche may appeal to you.

Find Extra Snowflakes! Let’s make it a game to find extra money for paying off your debt. Do whatever you can to increase the income side of the equation and decrease the expense side of the equation. Every dollar counts, really.