Leverage Your Money Like A Bank!

Banks don’t lend money.

They lend the money somebody else left there. ~Adam Smith

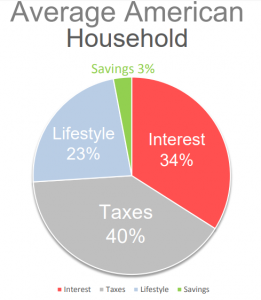

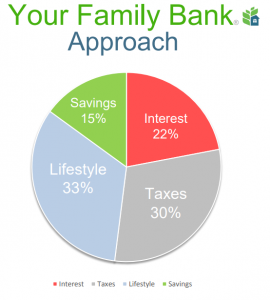

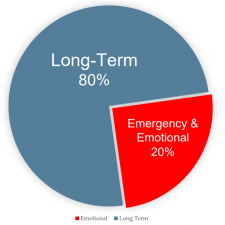

Save. Save. Save. That’s a favorite mantra of financial planners who say we should set aside savings for emergencies, major expenditures and other spending. The idea is, be ready with cash rather than credit when we need to make a purchase. We all agree that saving money is important. But, is our savings account the best way to save? It may be hard to believe but using our savings account the wrong way can actually end up hurting our finances. I’ll explain why.

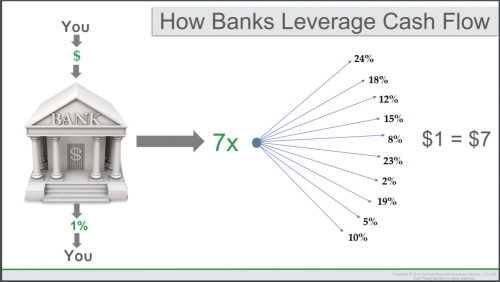

We think of banks as financial intermediaries that connect savers and borrowers. However, banks actually create money that is a multiple of our deposits. Simply, here’s how it works. You walk into a bank and deposit your salary, say $1,000. The bank holds back a small “reserve,” say 10% (in this case $100) and lends $900 to somebody who needs a loan. So, the borrower takes this $900 and spends it at a local car dealer. The car dealer doesn’t keep the cash in its office and takes the money back to another bank.

Now, the bank realizes that it can use the bulk of this money to make another loan. It also holds back 10% ($90) and lends out the other $810 to make another loan. Whoever borrows the $810 spends it and, again, it comes back to yet another bank. That bank keeps 10% ($81) and makes a new loan of $729. This process of (re)lending continues … the same money is lent over and over again with 10% of the money being put in the reserve each time. The customers who deposited money into the bank still think their money is in the bank.

Have you ever wondered why your checking account is free? Deposits create loans and consequently banks need your money in order to make new loans. Big banks make big money! Park your savings in an average account, and you’ll miss out on money.