Remove Risk From Your Life

As investors, we realize the stock market is a volatile place to invest our money. And, with volatility comes loss – like the gasp-worthy loss you may have seen on your computer a few months back. When it comes to risk, everyone has radically different ideas about what’s tolerable, but when the financial markets are unsettled, investors naturally look for lower risk investments. Let me ask you: Are you concerned about the return ON your money or the return OF your money?

If you’re worried about the direction of the stock market, it is possible to obtain guaranteed tax-free continuous growth with no exposure to the stock market. The financial decisions you’ve made to automatically invest a percentage of your income for compound returns has you in the game. Now, let’s stay in the game long term! You can lose all if you’re not careful where you put your money. The simple investment lesson here is: What goes up will come down.

Security First!

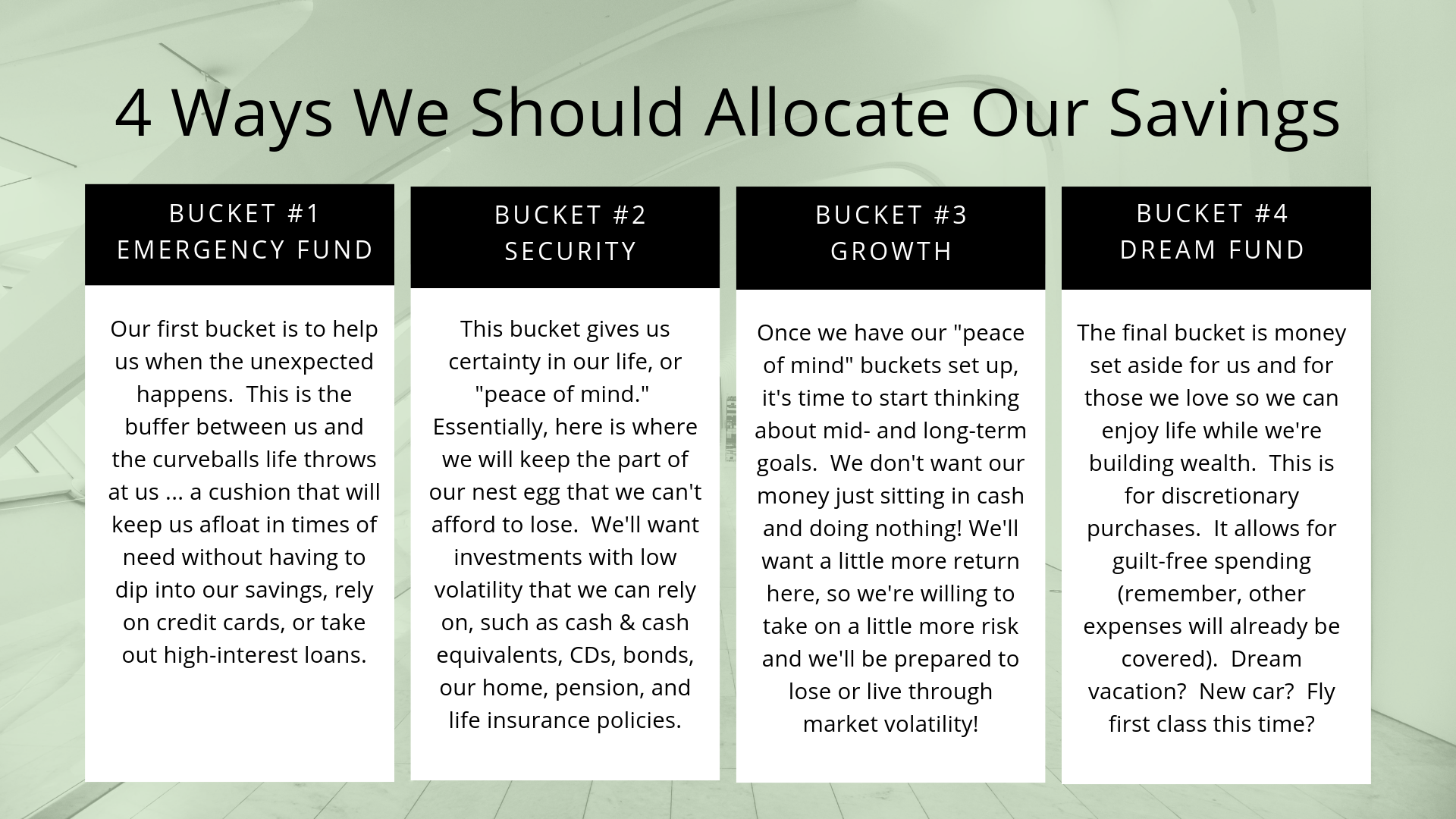

Safety is a primary concern in any financial strategy. Taking a calculated, understood and informed risk is one thing. But, exposing ourselves to unnecessary risk which could easily be avoided is another. When it comes to money we’re counting on and especially money we’ve worked so diligently to save and expect to have access to during our retirement, we want to make sure it’s stored in a safe place.

Which places are safe? Massive amounts of advertising have conditioned us to store our money in banks, both short term and long term. But, are banks the safest place to store our money? Let’s start by considering what the overall purpose of a bank is. Their sole reason is to make money … but, who are they making money for? A bank’s primary responsibility is to make money for their STOCKHOLDERS so they can get a return on their investment. After all, that’s why the bank was created in the first place.

Looking for an investment that will keep you safe in times of trouble? A mutually-owned life insurance company, on the other hand, is responsible for making money and providing a return to their POLICYHOLDERS … which would be us! There are no stockholders in a mutual life insurance company to satisfy.

Executives at banks are responsible to their stockholders, meaning they have incentive to take risks. They are focused on maximizing quarterly profits in order to appease stockholders.

Executives at mutually-owned insurance companies answer to their shareholders who are the policyholders. They have a totally different mindset as they’re NOT pressured to take risk to maximize short-term profits to stockholders. This allows management to always have in mind the long-term safety, security and return to us, the policy owner.

What we gain by using the concept of high cash value life insurance is safety and guarantees – to the extent that banks put billions of dollars into cash value life insurance to protect their capital.