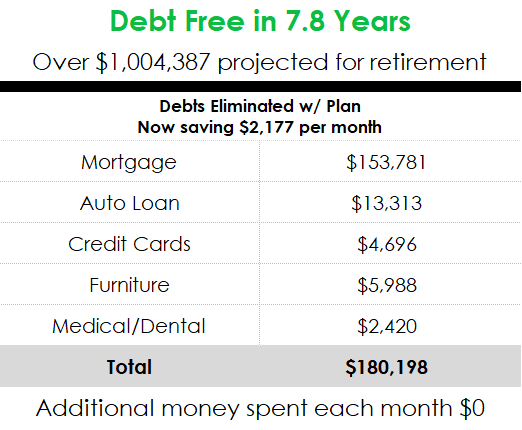

How do you get out of debt and build your savings at the same time? It is possible – and we can show you how. The first step of most financial preparation processes is debt reduction. It makes a lot of sense when you learn that the average American household has over $135,000 in debt. Auto loans, mortgages, student loans, and credit card debt can pile up and make it seem as if there is no way to get a leg up. If you’re paying more interest than you’re earning in interest, you’re losing money.

No one wants to go into debt. Unfortunately, keeping those red marks out of your ledger is easier said than done. Dave Ramsey’s debt free advice is to stay out of debt altogether. But, in all fairness, that’s not what most American households do when they listen to the conventional financial wisdom. For millions of us, this is what happens in practice: After we siphon off some of our paycheck into stocks and bonds which we can’t touch until retirement, we then discover that we can’t afford our desired lifestyle. So what do we do when we want to buy a car or a house, send our kids to college, or pay for a wedding? Because the government won’t let us access our “savings,” we reach for the credit card or go hat-in-hand to outside creditors.

The conventional wisdom of putting money into a 401(k) is clearly not working for any household carrying credit card debt. The Federal Reserve may use a “zero interest rate policy” but the credit card companies certainly don’t. If a debt-strapped household can somehow manage to pay off its $17,000 of credit card debt rolling over at 16%, that’s the equivalent of a guaranteed rate of return of 16% on a $17,000 investment. Think you can find a stock that will return 16% in the next year?

Typical financial planning and advice has failed us. We are part of a grassroots movement of advisors, investors and consumers all working together to take back our thinking (and our money) from the financial institutions, corporations or the government that too often put their own best interests first. Designing a “conceptual banking system” for hundreds of clients have allowed them (and us) to sleep better at night knowing their money is guaranteed to grow independently of the stock market.

Our debt elimination program is a revolutionary new approach to a 100-year-old solution that will provide you financial freedom. It’s time tested and proven to solve today’s debt burden. Far too many people don’t realize that there is an alternative. They believe financial institutions set the rules and there is nothing they can do. Actually, there is another way, and we’re the experts who can help you transform how you use your money so you get more use out of it. We want to help you achieve true sustainable wealth without having to rely on Wall Street, the Big Banks, the Government, or a bull market.